There are many different terms when we talk about tokens. You have tokenizing, utility tokens, equity tokens, but also non-fungible tokens. We will discuss the latter in this article. Because what is a non-fungible token?

It is important to first know what non-fungible means. For that, we look at the difference between fungible and non-fungible. Then we can explain how non-fungible tokens can be used.

What are NFTs (non-fungible tokens)?

A non-fungible token, abbreviated as NFT, is a token that represents something unique. When something fungible, it means it is easily replaceable. So it is something that is not necessarily unique and identical. For example, we can give a note of 5 euros. Or a bottle of Heineken. These are not unique items: there are many of the same item.

So when something is non-fungible, it means it’s the opposite of fungible. It is something that is unique and identical; there is only one of them. Consider, for example, a ticket to a football match. There are of course several football tickets for the same match, but your ticket contains a code, name, and seat, making your ticket unique. For example, you wouldn’t be able to enter with someone else’s ticket.

It is now a lot easier to explain what a non-fungible token is. So a non-fungible token is a token that represents something unique. Suppose you tokenize that same football ticket, it is a non-fungible token. The token represents a unique asset.

The difference with normal tokens

The main difference with normal tokens is how unique an item is. Suppose you send 1 Ethereum to someone, and then they send 1 Ethereum back a week later. You would then not notice if you got exactly the same Ethereum back. It can be that you get another Ethereum back. So this is the same as the example with the 5 euro note.

These normal tokens use the ERC-20 protocol. This is also by far the most widely used protocol for tokens. Non-fungible tokens, on the other hand, use the ERC-721 or ERC-1155 protocol.

This protocol ensures that tokens are unique. To explain it simply, you could say that this protocol gives each token a unique number.

The unique number allows you to check whether you have owned the token you receive before. You cannot do this with a fungible token.

In addition, you cannot share a non-fungible token. For example, it is not possible to send half of a non-fungible token. You will therefore have to buy or sell the token in its entirety.

ERC-20, ERC-721, and ERC-1155; what is the difference?

The difference between NFTs and normal tokens is therefore mainly caused by the protocol that is used. Normal tokens use ERC-20, and NFTs use ERC-721 and ERC-1155.

ERC-20

The best-known protocol for tokens is ERC-20. This protocol is used on the Ethereum blockchain by, for example, Uniswap, yearn.finance, and $LEND.

This protocol ensures that there is no difference between tokens. Nothing unique is linked to the tokens. This allows you to divide the tokens and then sell these parts again.

ERC-721

ERC-721 is the best-known protocol for non-fungible tokens. It ensures that tokens are made unique, which makes them different from each other. Some simple games (CryptoKitties and Sorare, more on this later) use ERC-721.

ERC-1155

A lesser-known and newer protocol is ERC-1155. This protocol can therefore be used for more complex situations. An example is World of Warcraft. When players start playing, they get different items, such as a sword or gold.

Using non-fungible tokens, players can get unique items that only 1 player could use.

The advantages and disadvantages of non-fungible tokens

Because a non-fungible token is unique, it is possible to obtain data about the token. For example, you can find out who the previous owners of the token were.

This is because it is stored in the metadata. This can make a non-fungible token worth a lot more. The origin can be traced back, which ensures more confidence for the new owner.

However, there is also a disadvantage to non-fungible tokens. These tokens are not yet as accepted as fungible tokens. This is partly because ERC-721 and ERC-1155 are still fairly new techniques, which means that there are fewer developers who can build dApps (decentralized applications) for non-fungible tokens.

It is, therefore, possible that non-fungible tokens will be used a lot more in the future since the technology is very strong. However, time will have to tell us.

Use cases of non-fungible tokens

Non-fungible tokens can be used for many different situations. For example, it can be used in the gaming industry, but it is also useful for more serious situations.

Think, for example, of storing birth certificates, diplomas, or identity documents. These are all unique items that can be tokenized into a non-fungible token.

Non-fungible tokens for gaming

There are several games that already use non-fungible tokens. One game that has been using non-fungible tokens for a number of years is CryptoKitties. Here people can become owners of a digital cat.

A real cat is of course always unique. It has its own name, its own character traits, and its own date of birth. And that is also the case with these crypto cats. These digital cats can be bought with Ethereum. In 2017 alone, $12 million worth of crypto cats were sold. But non-fungible tokens are also used for other games.

There is also a game called Sorare where you can save football tickets. There are 10,000 unique football tickets that are all stored on the Ethereum blockchain. Because each card is unique, this is a perfect example of a game that uses non-fungible tokens.

Tokenizing with NFTs

You may be familiar with tokenizing. This is converting assets to tokens. Think, for example, of art. Suppose someone wants to sell a painting by Van Gogh. The value is estimated by the owner at €1,200,000.

Still, the owner prefers certainty, so he decides to tokenize the painting. He can do that by selling 1000 tokens for €1,200. These tokens then all contain a unique number because the owner of the tokens and the painting are unique. So these are non-fungible tokens.

The owner of the painting then has the estimated value when all tokens have been sold. The buyers of the tokens then own part of the painting.

Should the painting be sold at the auction for €1,600,000, the buyers of the tokens will have made a profit of €400. You could say that the original owner of the painting made a loss of €400,000.

In addition to being able to tokenize with NFTs, non-fungible tokens can also be used to support decentralized finance. And that’s a good thing because DeFi is one of the most emerging technologies of 2020.

What types of NFTs are there?

There are different types of NFTs, but the most important are:

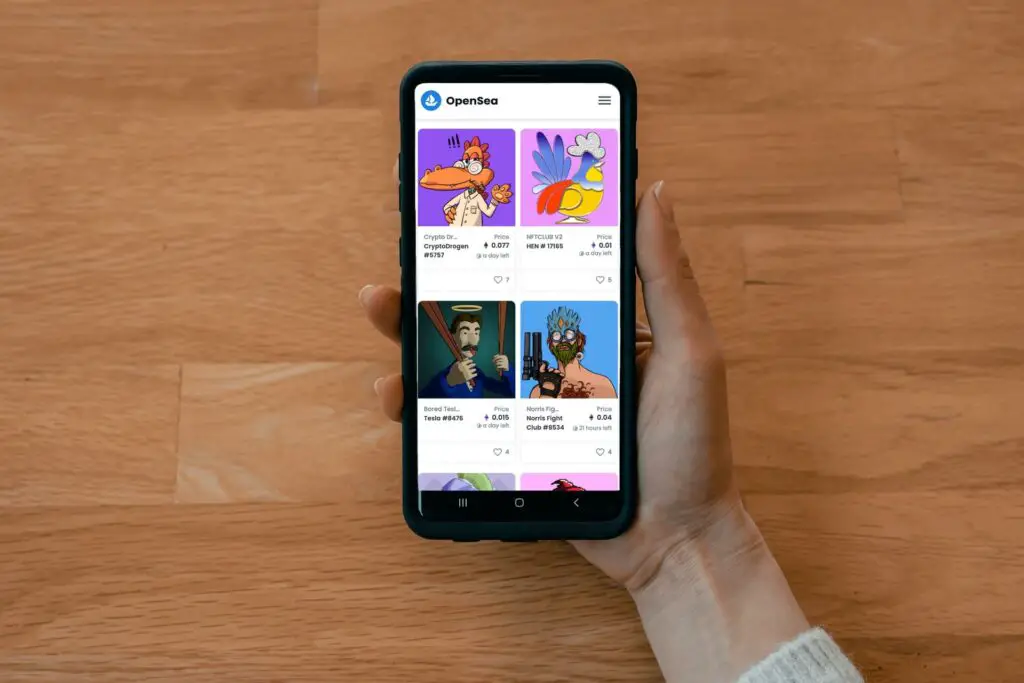

PFPs

OrProfile Picture NFTs. As the name suggests, these are mainly used as a profile picture on social media and forums.

A good example of this is BAYC aka The Bored Ape Yacht Club

Digital Artwork

These NFTs are considered art but since they only exist digitally they are considered digital art. They are being sold for millions just like real-life art pieces.

A good example of this is ArtBlocks

Collectibles

As the name suggests these are digital collectibles that trade for good amounts of money.

A good example of this is NBA Top Shots

Music NFTs

Ending an era of piracy, music NFTs can be used by artists and producers to offer their music and extras to fans without having to worry about piracy.

A good example of this is the “Dream Catcher” NFT by famous DJ Steve Aoki which netted him a cool $4.25 Million.

Gaming NFTs

BlockChain games and Play-To-Earn Games are getting increasingly more popular and so are Gaming NFTs. Allowing players to actually own an in-game weapon instead of it being on the servers of the game developers is huge. And you can earn a nice extra income from these NFTs as well.

A good example of this is Axie Infinity

Metaverse NFTs

Virtual land will eventually become as valuable as real land you own. There are countless success stories of people who were among the first to buy Virtual Land. Once the Metaverse is finished and people are going to be living part-time there, this land will only go up in value, even more than it is currently.

A good example of this is Decentraland.

What are the different types of NFT utility?

When you are starting out with NFTs there are a lot of words being thrown around, and it’s hard for beginners to know what they mean. That is why I will list all the different utilities NFTs can have and that you will hear below:

DAO

DAO stands for “Decentralized Autonomous Organization”. So in layman’s terms, this means a community wallet that holds money and that money in the DAO can only be used on things the community votes on. So you as the NFT owner have a saying in what the DAO of the NFT you are holding can buy.

The DAO is usually funded by the money that is made selling the NFTs of that DAO.

Staking

This is where you take the NFT you bought or minted of any exchange and put them in a combined pool along with other holders of the same NFT collection. Usually, you get rewarded a utility token as an incentive for staking your NFT.

Remember that staking your NFT usually involves gas fees for both staking, and afterward unstaking, so be sure that you know what cost is involved BEFORE you stake your NFT.

Burning

Burning your NFT means that it will be taken off the Blockchain and you will no longer have access to it. You normally burn your NFT for an upgraded NFT of that collection.

Breeding

Breeding is where you hold at least two NFTs of the same collection and you “fuze” them together to get a “baby” of said NFT. You can then hold or sell this baby for a profit.

Utility Tokens

Utility tokens are the tokens that you will receive for free (usually Daily) for staking your NFT. If the project is doing great then the value of that utility token will rise and be worth more. This way you can earn passive income by just buying and staking an NFT.

A good example of this is the $Banana token which is currently worth $2. For every CyberkongZ NFT you hold, you receive 10 $Banana a day which equals $20 a day, $140 a week, $60 a month, and $720 a year for just holding onto your Cyberkongz NFT. (It has been as high as $12 per token, you do the math on what that delivered owners passively 😉)

I hope you see the potential for passive income in some NFT projects.

Fractionalization

This is a term that is thrown around a lot in the NFT space and it simply means that you own a small piece of a (very) expensive NFT.

So let’s say you want a CyberPunk NFT and you don’t have an extra $400,000 laying around, then you can invest in a fractionalized NFT of that CyberPunk, and you and a thousand others can own a small piece of that CyberPunk NFT, that’s how fractionalizing NFTs works.

Airdrop

This is where you get “airdropped” a new NFT into your wallet without you having to do anything for it. You can then hold or sell this new NFT for a profit.

How NFTs can support DeFi

DeFi is another topic that has become wildly popular in the world of blockchain and crypto in recent years. Non-fungible tokens can play a nice and supportive role in this.

DeFi (decentralized finance) is all about converting financial systems that currently still run centrally into a decentralized system. Think, for example, of the servers of insurance companies and banks.

When someone damages your car, both insurance companies must first be contacted, who then have to sort it out again. This is because they cannot access the data of individuals outside their company.

Should this all run on a blockchain, insurance policies could be stored as NFTs. An insurance policy is unique: it always contains a unique policy number.

What is the advantage of NFTs in this situation? In that case, the processing of damage could be done much faster. Only authorized persons can request the data because DeFi uses smart contracts. So you no longer have to constantly call up and down.

This is just one of many examples where non-fungible tokens can be used for DeFi. As such NFTs support the development of decentralized finance!

Conclusion

Non-fungible tokens are therefore extremely popular and the number of situations in which they are used is growing every day. This is because NFTs offer more options than normal tokens; NFTs allow items to be made unique. This can be compared to an ID card, passport, or diploma. There is only one of them.

This is also the difference with normal tokens. These normal tokens can be compared to a 5 euro note. This note is not unique. Normal tokens can therefore be divided.

The different situations in which NFTs can be used bode well for the future. In combination with the emerging DeFi, a lot is possible when it comes to decentralizing different systems.